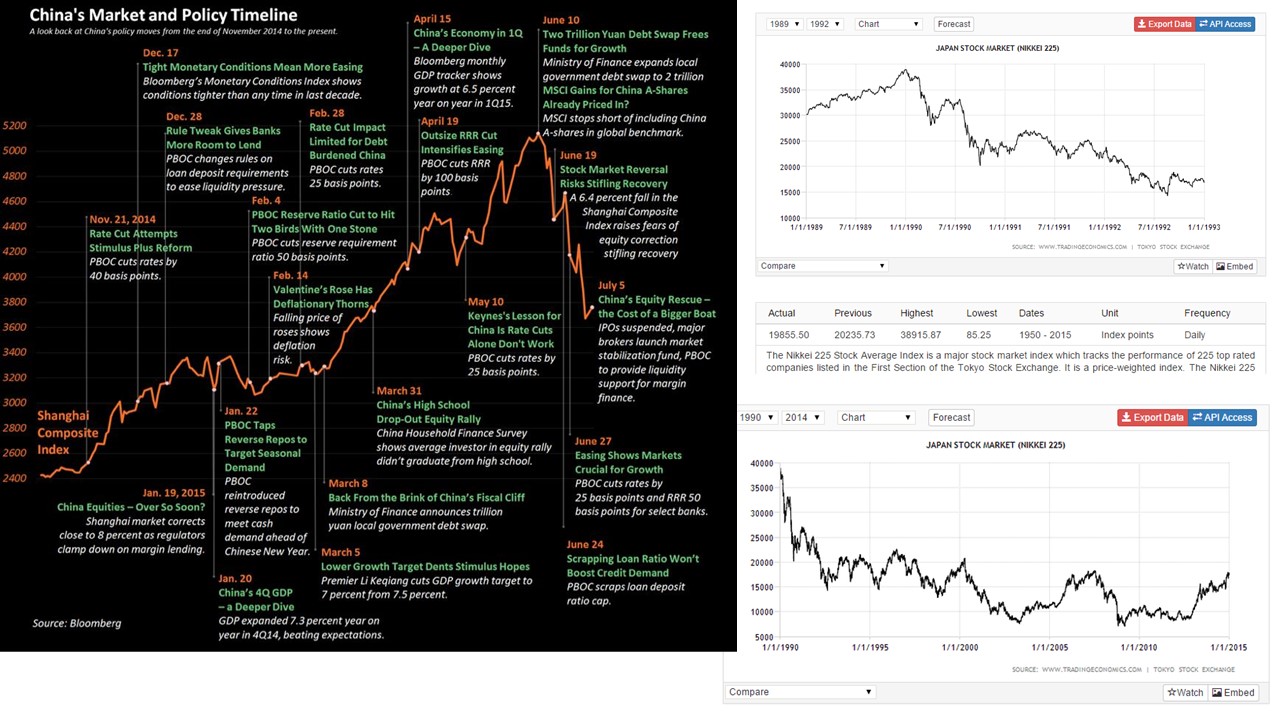

There are many parallels between yesterday's Chinese equity market crash and the Japanese equity market crash of 1990. The Japanese crash in 1990 was led by a crash in real estate prices and the same happened in China almost a year ago, following which Chinese government started an aggressive stimulus. Read full details here: These 5 charts link the Chinese stock market crash to problems in property. Source: WEF The market patterns too are exactly identical for both the crashes as can be seen in the attached figure.

Details of the Japanese market crash can be found on Wikipedia here: Japanese Asset Price Bubble Reports on the Chinese market crash are available here: Chinese stocks plunge to a 3 month low

China and Japan are both industrial economies dominated by the exports sector. Leading into the crash, both the economies were being driven largely by exports of manufactured goods. The demographic trends in Japan and China are also very identical because of the fact that they are pretty closed economies with respect to immigration and the population ages are tending to increase. In China this is partly due to the one child policy of the government.

Given the identical demographic, economic and financial trends, it seems as if China is headed towards the Japanese Lost Decade of the 1990s. The equity markets did not give any net returns over the 1990s in Japan and the economy was plagued with deflation and lowering corporate profits. Only the Japanese export powerhouses were able to grow in this period. Details of this are also available on the previously shared Wikipedia link. Many efforts were made to revive the economy and produce inflation and growth and they all failed.

This changed with the economic policies of Shinzo Abe, popularly known as Abenomics. He introduced a quantitative easing program and starting injecting money into the system through government and corporate bonds. This rapidly devalued the Yen and started increasing the demand, leading to the first recorded inflation of prices since the crash of 1990. The Japanese stock markets too have been seeing a rising trend since Abenomics have started.

In light of this, I think China can draw a number of valuable lessons from the policies of Shinzo Abe in Japan. Here are few articles on the same:

Investing in Japan: The Impact of Abenomics

What the 1990 Japanese stock market crash can teach us about the Chinese stock market crash

If history is a lesson, the future for China can be different from that for Japan.

No comments:

Post a Comment